Bitcoin is getting a ton of media attention as of late. Often times writers get it wrong. Here's a list that should be good for a laugh.

Reality: It's one thing to discuss whether we are in a bubble, but several commentators have declared it so. No one knows if we are in a bubble. Only time will tell. The argument for it being a bubble is that it "feels" like one. The argument against is essentially the network effect, that as Bitcoin gets used by more people for transactions, then more businesses will cater to a Bitcoin economy. This makes it more useful for people, so more people will use it. And more businesses will accept it and. . .

2. Claim: There is no way to break up a Bitcoin into smaller units. -Business Insider

Reality: Bitcoin can be split up into 100,000,000 parts called Satoshis. Bitcoin is also often expressed in millibitcoin or mBTC which is of course .001 BTC.

3. Claim: "No one knows who mint [Bitcoin] or who is controlling the supply." -CNN

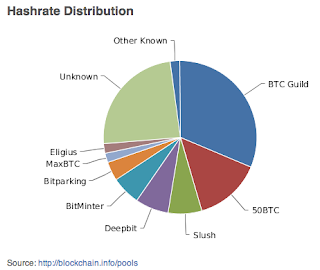

Reality: Bitcoin creation isn't mysterious at all, they are mined kind of like digital gold. And although it is hard to know who individual miners are, we do know that 75% of mining is done by some pool or other, according to bitcoin charts.

And as for the money supply, that is controlled collectively by anyone running the Bitcoin client and miners. Central to the Bitcoin software is that only a certain number of Bitcoin will ever be created and that they will be created at a certain rate (currently 25 BTC around every 10 minutes.) Miners create new Bitcoin and machines running the client confirm those new coins.

4. Claim: Bitcoin is a fiat currency. -New Statesman

Reality: From Wikipedia, "[f]iat money is money that derives is value from government regulation or law." Fiat money is as trustworthy as the government that issues it. Bitcoin is exactly the opposite of fiat money. It relies on no government or central bank. Instead, Bitcoin derives it's value simply from it's ability to be reliably used for barter. Far more can be said than that, of course.

5. Claim: "Someone could make counterfeit Bitcoins." -Business Insider

Reality: Every Bitcoin mined or transaction made has to be confirmed and recorded by the entire Bitcoin network, which is decentralized and peer-to-peer. Every transaction ever made is publicly available. Because of this, it is generally considered near impossible to counterfeit Bitcoin.

6. Claim: "The anonymous creators of Bitcoin could decide to create a lot more, thus debasing the value of the currency." -Business Insider

Reality: Although the identity of Satoshi Nakomoto (the progenitor of Bitcoin) is unknown, the operators of the Bitcoin Foundation are well known. The foundation operates similar the Linux Foundation, both are non-profit organizations that are responsible for maintaining their respective open-source frameworks.

The foundation has paid employees and relies on donations as well as grants from institutions that are keen on the continued strength of Bitcoin, such as Mt.Gox.

Because of the nature of the software, if anyone in the Foundation or Satoshi Nakomoto (him/her/ them?) wanted to mine new Bitcoin, they would have to compete with everyone else mining Bitcoin. Just like the claim in #5, there would be no way for them to magically make new coins.

And if they were to change the software such that they could magically make new coins, everyone would know about it, because the software is open-source. They would also still run into the problem of recording these magic coins on the blockchain.

I'm sure there are many more misconceptions, this is just what I could find while trying to keep up with the deluge of new media coverage in the last few days. Post comments if you find more out there, or if I too have made an error.

nicely written, just debunked all the major claims made by the media recently.

ReplyDeleteThis article does not address the real issue - The recent move in Bitcoin is due to an influx of mob money laundering. There is a reason why currency markets are heavily regulated. Seems now Bitcoins altruistic vision has become it's fatal flaw.

ReplyDeleteGiven a few more months this money laundering issue will either force Bitcoin to regulate it's activity, as do modern banks, or this Gorilla of mob money laundering will drag it down.

Great breakdown of how Binance Clone Script accelerate crypto exchange launches. One thing many startups overlook is liquidity integration and compliance readiness from day one. Curious to know—do you recommend starting with a white-label Binance clone or customizing it for regional regulations?

ReplyDelete