We’ve heard of Bitcoin buying beer in New York City, but a Los Angeles based cause has turned to the virtual currency to help save the life of Sabrina Xin, a dying 2-year-old Chinese orphan.

Xin has a congenital heart defect and will die soon without life-saving surgery, so a California couple is raising money to adopt the child.

“I had no real contact with Bitcoin until a friend suggested that I accept it for donations on save-sabrina.org,” said Josh Rubino, the site’s webmaster and brother to the couple. “But I am willing to explore all options available if it help’s save this girl’s life.”

“My friend educated me about everything I need to do to accept Bitcoin safely and securely,” said Rubino. "I feel that accepting Bitcoin is advantageous to our cause of saving Sabrina. Engaging with an entire online economy only broadens our chances of reaching our June 1, 2014 deadline."

For Save-Sabrina, Bitcoin makes sense. Bitcoin will give the cause several advantages, said Rubino.

“We were able to integrate a Bitcoin donation address into the site very quickly, enabling us to receive near-instant donations globally,” said Rubino.

The Rubinos’ receive paypal donations as well, but Rubino said it is not ideal, because PayPal charges a 2.9% and $.30 fee for every transaction. Bitcoin transactions cost a few pennies worth of Bitcoin and are often free, Rubino said.

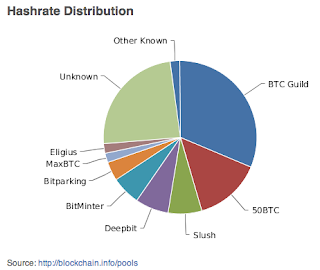

Anybody with access to the internet can use a site like Blockchain.info to see to see how much Bitcoin has been donated to the public address. This provides transparency to the public and helps foster trust, said Rubino.

"After the money has been donated, the amount received through Bitcoin will match the amount spent for the cause of adopting Sabrina and bringing her home," said Rubino.

"After the money has been donated, the amount received through Bitcoin will match the amount spent for the cause of adopting Sabrina and bringing her home," said Rubino.

Currently, the Rubino’s need $25,000 more worth of donations to finalize the international adoption, and any avenue of income, including Bitcoin, is a welcome source, said Rubino. Any amount in excess of what is needed for the adoption will be donated in whole to the Little Hearts Charity organization, which focuses on treating congenital heart defects in children.

Rubino is also campaigning locally in his Los Angeles neighborhood of Westwood. Local restaurants have agreed to host flyer drive events, where 10 percent of customer's bills will be donated to the cause. This represents a traditional form of fund-raising effort, but Rubino is excited about the potential Bitcoin could have in making a very real difference in a little one's life.

@Bitcoin_Trends

Full Disclosure: I know Josh Rubino personally. I am just trying to get the word out.